Provided Courtesy of Kaitlinn Thatcher of Axial.net

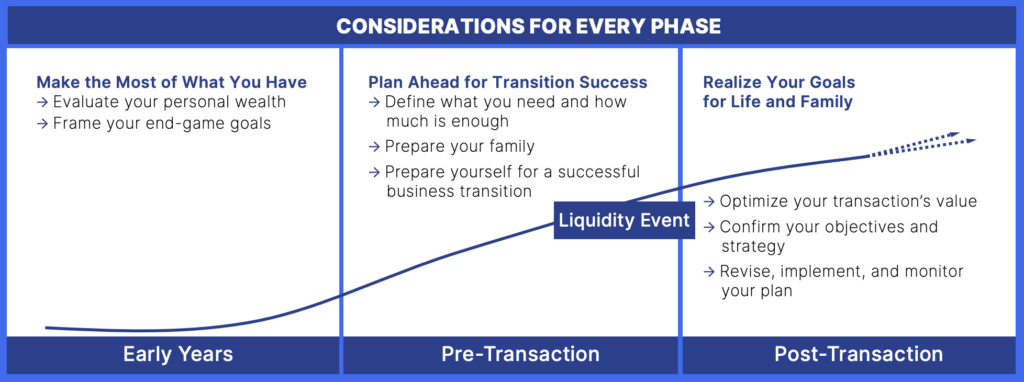

One of the challenges that business owners face is how to plan for a successful ownership transition. Whether it is a transfer of ownership to a family member, a management buyout, or the sale of the business to an outside party, the process requires careful consideration well in advance. This article covers the basics of business transition planning and important actions that business owners can take during each stage — from years before a sale to the weeks and months post-transaction.

The Business Lifecycle

The Early Years

In the early years stage, business owners should start thinking about their exit strategy and long-term vision for the business. Key actions that business owners can take during this stage include evaluating their personal wealth, identifying potential successors, and developing a thoughtful succession plan with the help of an advisor who aligns with the owner’s objectives and understands all stages of the business lifecycle.

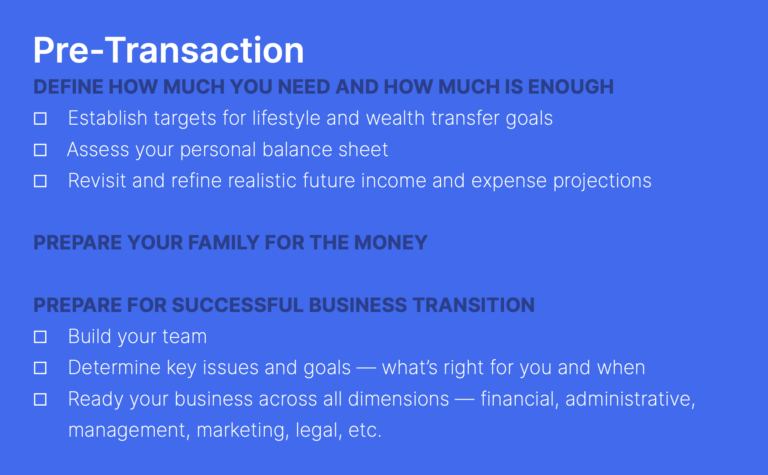

Pre-Transaction

The middle years of business growth offer a prime opportunity for deeper thinking and planning. At this point, owners often have a clearer vision and can make tactical preparations for their future transition by developing a comprehensive exit strategy. Making the right decision is not easy, but if the choice is made to sell the company rather than transition to a family member, working with an M&A advisor early on in the process can be tremendously helpful.

There are many resources available for business owners when it comes time to select an advisor and build your transition team. A few years ago, Axial created the Advisor Finder program to arm business owners and executives with the information needed to make confident advisor hiring decisions. Leveraging 10 years of behavioral data and relationships on the Axial platform, the program guides business owners through the M&A Advisor identification, interview, and hiring process.

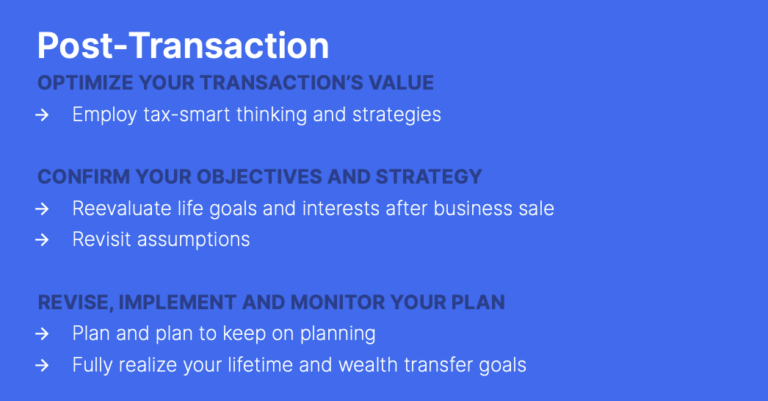

Post-Transaction Stage

Once a business has been sold or transferred, the focus shifts to optimizing the transaction’s value, reevaluating life and family goals, and planning and executing the post-sale investment strategy. It is critical to regularly revise, adjust, and enhance the post-transition plan to promote ongoing effectiveness, helping ensure success long after the sale.

Planning for a business ownership transition is a complex process that requires careful consideration and a well-thought-out plan. By starting early and following a structured planning process, business owners can ensure a smooth and successful transition.